This article is twofold. The first part deals with crypto influencers on Twitter and the second part takes a closer look at one recommendation that was given. It especially shows some tools to spot potentially unsafe investments.

Disclaimer: Take the first part with a grain of salt because it contains some speculation.

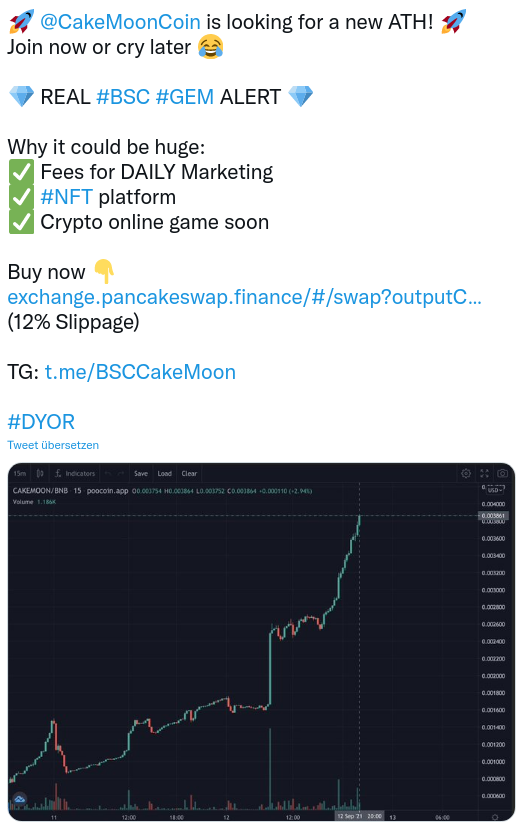

The Tweet

If you are interested in crypto and use Twitter, chances are you already encountered a tweet like this:

This tweet clearly advertises CakeMoon and suggests buying it now. Regardless of the hashtag #dyor at the bottom or the #nofinancialadvice in the profile.

I usually tend to be gullible and like to believe every recommendation I read on the internet. Yet, this time it was different. The fact that it recommended buying something that is reaching an ATH was immediately off putting to me.

You shouldn't do that. This might be the worst time to buy. Because all current holders will have amassed some returns. When they take them, it will result in an immediate price drop.

Further scrutiny of the coin revealed numerous red flags. It clearly looked like a scam to me and I could not understand how anyone could advertise this. The details will come later because I want to talk about the author of the tweet first.

The Author

It was from a self proclaimed "Crypto currency trading and business expert". "How odd!", I thought. "How could an expert recommend such a sh*ty coin?".

In the end it might not be too important whether this is actually an expert or an "expert". I guess, and this is only my speculation, that he was compensated for tweeting.

That is probably the reason why you see influencer reaching out to coins in the comments, proposing to "collaborate". Or why it sometimes happens that the exact same tweet was posted by multiple authors. Which was the case for this coin by the way.

There is a machinery at work behind the scenes. Big accounts selling exposure on their feed and smaller accounts that wish their tweets to be seen. This is by no means exclusive to the crypto space. It happens everywhere on Twitter and maybe even all of social media.

How could these accounts become big

Let's keep the tin foil hat on a little longer because there is more conspiracy to come.

What I find very odd is that some of these influencers do not provide "quality content". All they do is advertise unknown project, make groundless price predictions for the future and generate hype.

So how come that they have so many followers?

Admittedly, it is probably a naive idealization of mine to think that one must provide "quality" in order to get fame.

Aside from that I do believe that a self-propelling system is at work here. Let me explain.

The influencer is willing to function as a "billboard". Once they tweet about a specific coin, the community behind the coin will be mobilized. The task: like and retweet the tweet, write a positive comment and like other positive comments. Sometimes they might even follow the account themselves. On top of that, all this exposure will increase the reach of the influencer. His tweets will be presented to further users who might also follow.

This is based on my experiences in crypto communities. Whenever a big influencer tweeted, there was the call to action to "push" the tweet.

Closing thoughts

Feel free to take the tin foil cap off. Enough with the conspiracy talk (for now).

One might argue that every investor has the responsibility to research possible investments. A point of view that I myself hold. So when they listen to a random guy or gal on the internet, then it is clearly their own fault.

The point I am trying to make is a different one. Crypto is still in its infancy. The first steps into the world of crypto should be made as easy and as seamless as possible in order to increase adoption.

This will be hindered when big accounts are willing to "sacrifice" gullible users for their own profit. This is all the more dangerous when their tweets are targeting emotions by spreading FOMO or hype.

A Closer Look at the Coin

In a previous article I have already touched upon the topic of how to identify coins that are untrustworthy. Let's put these tips into action.

In order to ease into it, we will start with the website. Why? Because it is already full of red flags.

My overall impression … lack of content. The biggest and most detailed section is - oh what a surprise - the explanation on how to buy the token. But good luck on finding the whitepaper or details on the tokenomics. Only one detail is being revealed. There is a 12% tax on every transaction.

sarcasm on What else would you care about? The rest are just pesky details. sarcasm off

They list the usual suspects when it comes to socials. Funny detail. Even though Medium is listed there, the link actually leads nowhere. In my opinion, that would be the most respectable platform. But it also requires some work. sarcasm on So I can understand why you would not want to bother with it. sarcasm off

Further down is a road map. Which makes it seem like the team is ambitious. If it weren't for the fact that this road map is aggravatingly generic. They plan on having a game, an own exchange, a merch shop and of course NFTs should not be forgotten. This lacks innovation as much as it lacks details.

But hold on! The merch shop might be not too far off. At least there is sample merch at the bottom of the page. But the search for a way to buy those is in vain. A second look shows that the sample merch is just a couple of logos that were hastily slapped onto the image of a black shirt.

I even found an easteregg in the footer of the page. It links to the github profile of the project. So is that their saving grace? Are there actually hard working devs behind the scenes that share their creation with the world? Well, if they are, then they make sure not to let you know, because they do not have any public contribution.

The Token

Let's leave the website - which already was so full of red flags that any bull would go wild - for now. But we are not yet done. Far from it! We will now delve much deeper into this rabbit hole. For that we will use the insights provided by poocoin.

I was not surprised to see a lot of red after it went for the ATH that was mentioned in the tweet. So potentially, people who have bought it after seeing the tweet have lost some money. Here you can find the latest graph.

Much more interesting is the dev wallet checker. This tool shows all transactions that were done with the wallet of the developers.

Remember how the details of the tokenomics were missing? Now we can see why this is a bad thing. Because the total circulating supply is unknown.

The total supply amounts to 1 billion tokens of which only 13% was used for liquidity in pancakeswap. So where is the rest?

The top holders section can answer this question. A whooping 75% were distributed to different wallets among which a single wallet holds 41%.

Of course, I do not know any details and maybe this is the marketing wallet of the team. But I can't help but think of this as the sword of Damocles dangling over all the current token holders. Because if this wallet sells a major negative price impact will follow.

Final Thoughts

Having written this article, I feel somewhat devastated. I would love for crypto to flourish, to become mainstream. But it feels like it is still a long way until that is possible.

Hopefully, this article has taught you something. Expanded your arsenal of tools against scams and made you a bit more resilient against the recommendations of influencers.

But there is no time to mope. This will not be the last article of mine about this topic.

Feel free to share your stories in the comments. Have you ever listened to an influencer and regretted it afterwards?

Also, if you want to stay up to date about me and my writing, then consider joining my newsletter.